We represent our members' interests towards policy makers and, as a knowledge partner, are dedicated to constructively contribute to EU policies relevant to our industry.

Metal Packaging Europe positioning on the PPWR

The European metal packaging industry, with 85.5% of steel packaging and 73% of aluminium beverage cans recycled in 2020, is perfectly placed to contribute to the circular economy goals of the EU Green Deal and welcomes the introduction of performance grades to assess the recyclability of packaging.

The key policy principles of MPE support the consistent position taken by the European Parliament in the CEAP (par. 39.), which underlines the need to: ”maintain materials at their highest value and to achieve clean, non-toxic and sustainable closed material loops; stresses the need to increase the availability and quality of recyclates, focusing on the ability of a material to retain its inherent properties after recycling, and its ability to replace primary raw materials in future applications”.

🔍 Discover our latest resources on the PPWR:

- Council misses opportunity to adopt strong recyclability criteria and unleash the full potential of highly recyclable materials 12/23

- PPWR – Recognising the role of high-quality recycling in a circular economy 11/23

- PPWR - Permanent Material Alliance welcomes European Parliament’s ambition on recyclability 11/23

- PPWR - Building a sustainable future for packaging in Europe 10/23

- Reusable packaging in Europe - Between facts and fiction - Interview with Packaging & Recycling Technology Expert 09/23

- Discover our new infographics: Improving circularity for beverage packaging in Europe 05/23

- MPE Position paper on the proposal for a regulation on packaging and packaging waste (PPWR) 05/23

- Over 120 industry associations call for safeguarding the internal market legal basis of the PPWR – 05/23

- Sustainable Metal Packaging Put At Risk By PPWR Proposal 11/22

PPWR – Focus Areas (PDF version available here)

1. Definitions

Current definitions of ‘reusable’ and ‘recyclable’ packaging must be unambiguous, with measurable indicators and tools to enable performance monitoring.

‘High-quality recycling’ should be defined and include the ability of a material to withstand multiple recycling loops without any change to its inherent properties. ‘High-quality secondary raw material’ should also be defined. To ensure that ‘permanent materials’ contribute to achieving the objectives of a circular economy, this category should be recognised and defined at the EU level.

2. Recyclability

Criteria to assess recyclability should be clear, harmonised among materials, and enforceable. Recyclable packaging formats should be collected, sorted and recycled at scale into secondary materials with sufficient quality to substitute primary raw materials.

3. Eco-modulation

The eco-modulation of extended producer responsibility (EPR) fees can incentivise the production and use of sustainable packaging. MPE supports the link between recyclability and eco-modulation of fees.

These fees should reflect the ease with which each packaging type can be collected, sorted, and recycled, even after numerous recycling trips. Fees should vary depending on the volume of the packaging, with lower fees applying to smaller-sized packaging.

4. Reuse

Measures relating to reusable and highly recyclable one-way packaging should be complementary. In the spirit of fair competition among all packaging materials and formats, the true benefits of reuse should be critically assessed via an impact assessment.

There is currently insufficient data to conclude that the environmental benefit of reusable packaging is greater than that of highly recyclable one-way packaging across all product categories and all markets.

5. Waste Prevention

Before imposing strict packaging waste prevention measures, the role of packaging should be considered. Packaging is designed to protect and preserve a product, convey information, and make it safe for consumers.

Packaging materials that extend shelf life have an important role to play in food waste prevention; only the amount of excessive packaging put on the market should be reduced.

Any reduction targets should take into account the clear differences in increased volumes put on the market per packaging material, as well as the circularity of the material.

6. Deposit Return Schemes (DRS)

Well-functioning DRS will play an essential role in achieving the circular economy ambitions of the EU and are pivotal to reaching our 100% recycling target for aluminium beverage cans by 2030, as set out in the Beverage Recycling Roadmap.

Minimum requirements are essential to ensure harmonised principles in a single market and interoperability across EU Member States.

7. Labelling

Consumers have an important role to play in supporting the transition to a circular economy. Labelling is crucial in order to help ensure that the most sustainable packaging options are chosen and that the packaging is correctly disposed of at its end-of-life.

Joint industry packaging value chain recommendations for the legislative review of the WFD and PPWD

Together with 35 other packaging value chain partners, Metal Packaging Europe provides cross-industry recommendations for the legislative review of the WFD and the PPWD in the upcoming months.

PCF Post-Plenary draft statement

DownloadCommon industry call to safeguard single market

Together with 127 other industry associations, we urge the European institutions to safeguard the Internal Market legal base (Article 114 TFEU) of the PPWD to ensure its dual objective of the free circulation of packaging and packaged goods, as well as effective packaging waste management.

127 National and EU industries call to safeguard the Internal Market for Packaging and Packaged Goods in the Circular Economy Package

DownloadCircular Economy in a nutshell

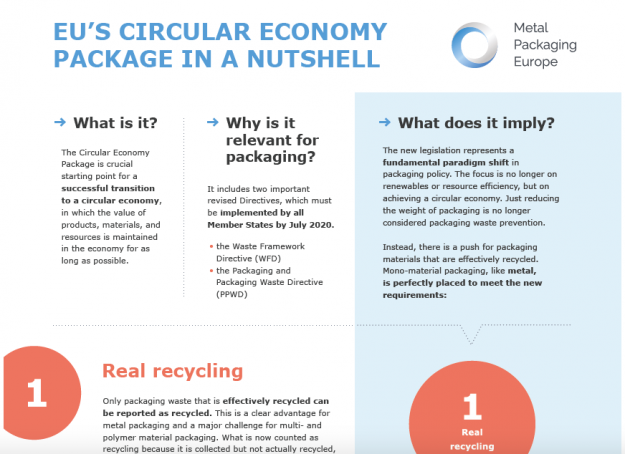

The Circular Economy Package has introduced a fundamental shift in packaging and packaging waste policy, making circularity the reference point. The Circular Economy Package is crucial starting point for a successful transition to a circular economy, in which the value of products, materials, and resources is maintained in the economy for as long as possible. Find out what it implies and where metal packaging is placed in the below factsheet.

EU's Circular Economy Package in a nutshell

DownloadEconomic Footprint: Consumer rigid metal packaging in Europe

Our membership covers more than 760 companies, employing over 177,000 people. 90% of member companies are small and medium-sized enterprises. Together, they produce some 98bn units every year for the beverage, food, health & beauty, household and industrial markets. Find out more about the metal packaging industry in Europe in the factsheet below.

Consumer rigid metal packaging in Europe

DownloadConcept of Permanent Materials

In order to move towards a true resource efficient 'Recycling Society', it is key that we make a clear distinction between recycling which leads to gradual degradation of the material and recycling which keeps the material in the loop without losing its intrinsic characteristics. Made from permanent materials, metal packaging saves resources and it ideally placed to contribute to the Circular Economy.

To learn about the two pillars of the Concept of Permanent Materials, i.e. inherent material properties and material stewardship, please see the Carbotech study. A summary and presentation are also available for download below.

Find out more about our sustainability story here.

LCA & LCI Dataset

The Metal Packaging Europe Life Cycle Assessment (LCA) studies identify the average environmental impacts of metal packaging manufactured in Europe throughout its life cycle. The reports showcase the industry’s contribution to sustainable development, which is perfectly aligned with circular economy thinking.

Two LCAs are available respectively for beverage cans and for non-beverage packaging: the former covers aluminium beverage cans (25, 33, 50 cl) based on 2016 production data, the latter covers aerosol, food, general line, and speciality sectors based on 2013 production data. For LCA modelling, the Life Cycle Inventories (LCIs) are available for the life cycle (cradle-to-gate + End-of-Life) and for the can-manufacturing phase.

The Metal Packaging Europe Life Cycle Assessment (LCA) studies are ISO 14040/44 compliant and were conducted by RDC Environment, an independent international environmental consultancy firm, and peer-reviewed by Solinnen, an environmental consultancy specialised in LCA practices.”

Aluminium beverage cans

Aluminium beverage can recycling in 2020 remains high at 73% despite the impact of the new EU recycling reporting rules

DownloadAluminium beverage can recycling remains at a high 76% in 2019

Download

LCA of alu bev cans in Europe – Methodological report

Download

LCA of alu bev cans in Europe – Executive Summary

Download

Life Cycle Inventory (LCI) of the alu bev cans LCA study

DownloadMetal Packaging (excluding beverage cans)

Recycled content and the case for metal packaging

In the case of rigid metal packaging, only recycling will pay off: Recycling brings an environmental benefit no matter for which metal application the recycled material is subsequently used – the material loop is working. Whatever the next application or product (automotive, construction, packaging etc.), the environmental benefit occurs at the time of re-melting the collected metal packaging (when scrap substitutes primary material) and not at the point of re-shaping the secondary material.

Both, steel and aluminium, face a strong multi-market demand for scrap, which has always exceeded the supply of scrap. Given this market situation, a recycled content approach would divert the scrap flow from one stream to another, adding potential system costs and bringing no added environmental benefit.

Recycled content and metal packaging in the context of LCA modelling

In LCAs for metal packaging, the end of life recycling rate approach should be used as most adequate proxy. See further explanation in 'Recycled content and metal packaging in the context of LCA modelling'.